Introduction

ResCash: A Secure and User-Friendly Financial Accounting Solution

In our increasingly digital world, managing finances effectively is critical for both individuals and businesses. ResCash addresses this challenge with a cutting-edge accounting application that is secure, efficient, and intuitive. Designed with individual users and freelancers in mind, ResCash leverages advanced technology to streamline transaction handling, budgeting, and financial reporting. It redefines the way financial management is approached by combining distributed accounting principles, ResilientDB integration, and secure transaction management for a seamless user experience.

Technologies That Power ResCash

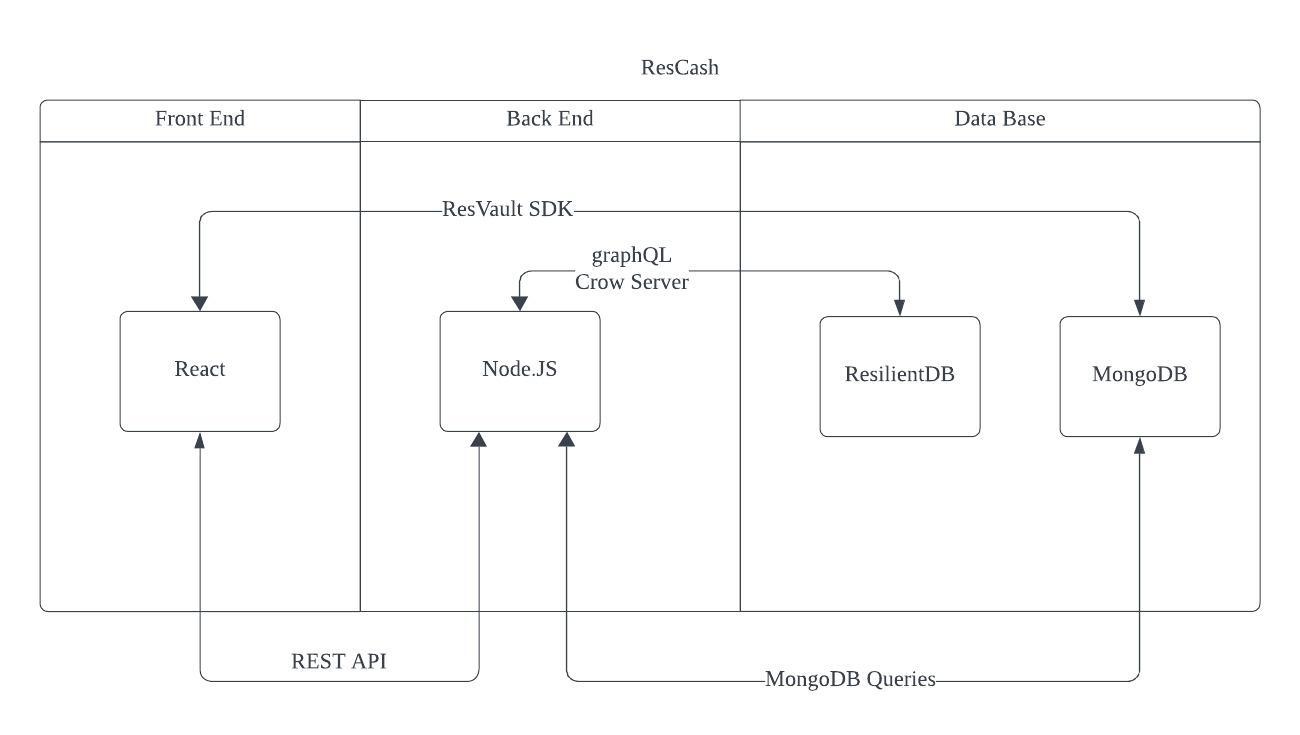

ResCash is built on a modern and robust tech stack, ensuring scalability, reliability, and ease of use:

- Frontend with React: A responsive and seamless user interface, delivering smooth interactions and intuitive navigation.

- Backend with Node.js: A high-performance environment for efficient API handling and business logic implementation.

- Database Integration:

- ResilientDB: A distributed database that provides top-notch security and reliability for critical financial data.

- MongoDB: A secondary database optimized for advanced features like sorting, filtering, and quick data indexing.

- Authentication via ResVault: Ensures secure and controlled access to sensitive data, enhancing user trust.

- Data Visualization: Interactive charts and dashboards make complex financial metrics, such as cash flow and net worth trends, easy to understand and actionable.

The Innovation

ResCash stands out by integrating distributed database technology with an intuitive user experience. It combines the reliability of ResilientDB with the flexibility of MongoDB, offering a platform that prioritizes data security, high availability, and advanced functionality. Detailed financial visualization tools and secure transaction management ensure ResCash meets the dynamic needs of modern users.

Why ResCash?

ResCash goes beyond traditional accounting tools by emphasizing security, transparency, and flexibility. Its advanced CRUD functionality, customizable reports, and real-time budgeting tools adapt to the diverse needs of individual users and freelancers. With ResCash, managing your finances isn’t just easier—it’s smarter, empowering users to take control with confidence and clarity.

Elevator Pitch

ResCash is the next generation of financial accounting tools, offering a secure, distributed, and user-centric platform. By integrating state-of-the-art technologies like ResilientDB and ResVault, ResCash ensures that your data is protected, accessible, and actionable. Whether you’re a individual user or a freelancer, ResCash simplifies complex financial tasks, giving you the insights and tools you need to succeed.

The Problem

The Commercial Opportunity: In an era where data security and transparency have become necessities for both bussiness man and college students, the ResCash accounting application sets out to redefine how individuals and small enterprises manage their financial records. Rather than relying on outdated methods prone to human error and data breaches, ResCash introduces cutting-edge blockchain-inspired solutions and distributed databases to ensure that every recorded transaction is secure and easy to use. While many competing appllications promise efficiency, few can match the level of data integrity and trust that come from a design philosophy centered on transparency and resilience. This quality positions ResCash as a credible choice for those who value long-term stability and security over quick, superficial fixes. There are too many college students and people who just starting working on their own small bussiness lacking of safety awareness in this society, becuase they still do not have much social experience. In that situation, ResCash provided a reliable way for them to manage their financial information in the absence of doubt. In our future plan, we can also cooperate with universities to build their own database, which increase the secuirty and customizability of ResCash.

Pain Points in Traditional Systems: Traditional accounting systems often leave users feeling uncertain about the sercurity and reliability of their financial data. Concerns over potential information theft and unauthorized access are widespread. With ResCash, these issues are addressed head-on. By employing a distributed database platform ResilientDB and MongoDB in this project, the application safeguards each transaction entry from spiteful interference. In doing so, it instills a sense of security and trust—key factors that appeal to college student and small bussiness man who want to maintain control over their financial information. ResCash’s capacity to preserve data integrity in any situation is one of its primary advantages. This distributed architecture is only little impacted by system failures and cyberattacks that would destroy a conventional, centralized database. Errors and interruptions barely affect the system’s overall performance because the data is duplicated and checked across several nodes. Knowing that their records are reliable and available whenever they’re needed allows users to log in.

Highlights of the ResCash: A distributed and secure strategy guarantees that the system remains operational and accessible even in the event of a single node failure or server interruption. Because of its resilience, data integrity is maintained and catastrophic outages that may ruin profits, undermine confidence, and damage a company’s brand are avoided. Additionally, teams can focus on strategic growth, innovative problem-solving, and strengthening client connections when they are freed from time-consuming troubleshooting by well-designed and effective solutions. Efficiency directly results in savings and a stronger competitive advantage; it is not a luxury.Investing in safe, distributed, and efficient solutions is ultimately a strategic decision that affects long-term trends and aids in businesses’ or college students quick adaptation, since the market is changing at a fast pace. Those that are prepared to reconsider their data management and security strategies and adopt methods that prioritize security and smooth efficiency will be rewarded in the future.

Our Solution

ResCash leverages cutting-edge technologies to provide a reliable, secure, and scalable cash flow management platform.

Foundational Technology

-

Distributed Database Architecture:

- Powered by ResilientDB, a state-of-the-art distributed database, ResCash ensures high availability, fault tolerance, and efficient transaction processing.

-

Cryptographic Key Integration:

- Cryptographic keys are utilized for secure user authentication and transaction management.

- Ensures immutable transaction records while protecting user data from unauthorized access.

Distributed System Security

-

Consensus-Based Validation:

- ResCash employs ResilientDB’s consensus protocols to validate transactions across distributed nodes, ensuring consistency and preventing fraudulent modifications.

-

End-to-End Encryption:

- Data transmitted between the client and the server is encrypted using industry-standard algorithms, protecting sensitive financial information from interception.

-

Access Control and Authentication:

- Secure authentication mechanisms, including the use of cryptographic keys and tokens, ensure that only authorized users can access or modify transaction records.

-

Fault Tolerance and Data Integrity:

- ResilientDB’s distributed replication ensures that transaction data is stored across multiple nodes. In the event of a node failure, data remains accessible and unaltered.

- Transaction logs are immutable, ensuring tamper-proof audit trails for regulatory compliance.

-

Periodic Security Audits:

- Regular audits and vulnerability assessments ensure that ResCash remains secure against evolving threats.

By integrating these distributed system security measures, ResCash provides a platform that not only ensures high performance but also guarantees data privacy, integrity, and availability, making it a reliable solution for financial management.

Core Features

-

Create Transactions: ResCash allows users to create detailed financial transactions with fields such as amount, category, transaction type, merchant, and payment method. Transactions are stored securely in ResilientDB for data integrity and MongoDB for efficient indexing.

-

Read Transactions: Users can view all transactions with advanced filtering options. The “Read” feature provides a structured display of transaction data, ensuring easy navigation and understanding. It supports personalized views based on user-specific data retrieved securely through token-based authentication.

-

Update Transactions: The update functionality allows users to modify existing transaction details, including amounts, categories, transaction type, merchant, and payment method, ensuring data consistency and accuracy.

-

Delete Transactions: ResCash implements a “soft delete” mechanism, marking transactions as inactive without permanently removing them in ResilientDB. This ensures data traceability while maintaining clean records for users.

-

Cash Flow Chart: The cash flow chart is a dynamic visualization tool that tracks the movement of funds over time. This feature provides a clear and comprehensive view of income, expenses, and net cash flow. Users can identify patterns, such as periods of liquidity surplus or deficit, enabling better financial planning. Income and expenses are categorized, helping users understand the sources of inflows and outflows. By monitoring cash flow, users can make informed decisions about spending, saving, or investing.

-

Net Worth Chart: The net worth chart provides a real-time snapshot of a user’s financial position by calculating the accumulation between income and expense. This feature is crucial for individuals and businesses to measure financial progress over time. Users can view how their net worth has evolved, with historical data displayed through an easy-to-read line chart.

Usage

Prerequisites

-

Install ResVault Chrome Extension

- Follow the instructions here.

- Ensure that the ResVault extension is connected to:

76.158.247.201:8070(You may substitute this URI with your own GraphQL server URI if needed.)

-

Install Node.js and npm

- Refer to the official guide.

- Confirm installation by running:

npm -v

Setting Up ResCash

-

Clone the ResCash Repository

git clone https://github.com/quiet98k/resCash -

Navigate to the Root Directory

cd resCash -

Set Up the Frontend

- Navigate to the frontend directory (same name as the root directory):

cd resCash - Install dependencies:

npm install - Start the frontend server:

npm start

- Navigate to the frontend directory (same name as the root directory):

-

Set Up the Backend

- Open a new terminal and return to the root directory:

cd resCash - Navigate to the backend directory:

cd backend - Create a

.envfile with the following configuration:MONGODB_URI=**** MONGODB_DB_NAME=**** GRAPHQL_URI=**** CROW_SERVER_URI=****- MONGODB_URI: MongoDB connection URI (customizable).

- MONGODB_DB_NAME: Database name.

- GRAPHQL_URI: GraphQL server URI (include the

/graphqlsuffix). - CROW_SERVER_URI: Crow server URI (must match the GraphQL URI).

- Install backend dependencies:

npm install - Start the backend server:

npm start

- Open a new terminal and return to the root directory:

-

Access the Application: Open your browser and navigate to:

http://localhost:3000/

Notes

- Ensure all URIs are consistent between

.envfiles and the ResVault extension.

Future Developments

1. Enhanced UI/UX Design

Objective: Improve the user interface and experience to make ResCash more intuitive, accessible, and visually appealing for all users.

Implementation Path:

- User Research:

- Conduct user interviews and surveys to gather feedback on pain points and usability issues in the current design.

- Perform usability testing to identify areas for improvement.

- UI Redesign:

- Revamp the interface with a clean, modern design using frameworks like Material UI.

- Prioritize ease of navigation with clear menu options and a step-by-step onboarding process for new users.

- UX Enhancements:

- Simplify complex blockchain-related actions with user-friendly workflows.

- Add tooltips, animations, and explanations for blockchain concepts to educate users.

- Implement a dark mode for user customization.

- Performance Optimization:

- Optimize the UI for speed by minimizing assets and using asynchronous data fetching to ensure smooth performance.

- Testing and Iteration:

- Use A/B testing to experiment with different layouts and features.

- Continuously collect user feedback post-launch and iterate on the design.

2. Multi-Currency Support

Objective: Enable ResCash to handle transactions in multiple currencies.

Implementation Path:

- Database Update:

- Extend the MongoDB schema to include currency fields for transactions.

- Store exchange rates in a separate collection for real-time updates.

- Blockchain Integration:

- Enhance the smart contracts or backend logic to handle currency conversions when needed.

- Support multiple token standards (e.g., ERC-20 for Ethereum-based cryptocurrencies).

- Frontend Changes:

- Add a dropdown menu for users to select their preferred currency.

- Display balances and transaction amounts in the selected currency.

- Implement a real-time currency converter using exchange rate APIs (e.g., CoinGecko).

- ResVault Update:

- Modify the wallet extension to support multiple currency wallets.

- Allow users to switch between wallets and manage private keys for each currency.

- Testing and Deployment:

- Conduct thorough testing to ensure accurate currency conversions and compatibility with blockchain protocols.

- Deploy the updates incrementally to avoid disruptions.

3. Smart Budgeting and Analytics

Objective: Introduce more budgeting tools and analytics to help users track and plan their spending more effectively.

Implementation Path:

- Budgeting Feature:

- Allow users to set monthly or weekly spending limits in specific categories.

- Store user-defined budgets in MongoDB.

- Transaction Categorization:

- Implement machine learning (ML) models to automatically categorize transactions based on descriptions or merchants.

- Use a library like TensorFlow.js for lightweight ML in the backend or frontend.

- Analytics Dashboard:

- Create an interactive dashboard to display spending trends, savings, and projections.

- Include features like:

- Monthly spending breakdown.

- Alerts for overspending in certain categories.

- Forecasting future expenses.

- Notifications:

- Integrate email or push notifications to alert users about budget thresholds.

- Use Node.js libraries like

Nodemaileror Firebase for notification delivery.

- User Testing and Feedback:

- Deploy the feature to a small group of users for feedback.

- Iterate based on user input to refine the budgeting and analytics tools.

4. Mobile Application Development

Objective: Expand the reach of ResCash by creating a mobile application for Android and iOS.

Implementation Path:

- Frontend Development:

- Use a cross-platform framework like React Native to build the app.

- Design a responsive and user-friendly interface optimized for smaller screens.

- Backend API Optimization:

- Ensure the backend APIs are mobile-friendly by optimizing response times and minimizing data payloads.

- Use tools like GraphQL subscriptions for real-time updates on mobile devices.

- Integration with ResVault:

- Develop a mobile version of ResVault.

- Ensure seamless interaction between the app and the wallet for signing transactions.

- Testing and Deployment:

- Test the app on emulators and physical devices for compatibility.

- Publish the app on Google Play Store and Apple App Store, adhering to their guidelines for blockchain apps.

- Push Notifications:

- Add push notifications for transaction confirmations, balance updates, and other alerts using Firebase Cloud Messaging.

The Team

- Yiming Feng [[email protected]]

- Implement Create Feature

- Implement Report Feature

- Application Testing and feature improvement

- Project management, coordinating between team members

- Qingyue Yang [[email protected]]

- The overall coding of the ResCash user interface frame

- Implement Home Page features

- Implement the Edit Feature

- Project management, creating project roadmap, and formatting reports

- Alex Chen [[email protected]]

- Implement Delete Feature

- Develop Net Worth function and chart

- Mark Le [[email protected]]

- Implement Update Feature

- Develop Net Worth function and chart

- Jennifer Liu [[email protected]]

- Implement user authentication

- Implement the backend of the Read Feature

- Jiawen Zhang [[email protected]]

- Implement the frontend of the Read Feature

- Implement the frontend of the CashFlow Feature